Previously, the annual gathering of Walt Disney Company’s shareholders was marked by stress due to a wealthy investor pushing for changes within the executive team and aiming to redirect the company’s direction.

This year, by comparison, will be less charged.

2024 saw a remarkable year for the studio division of a media and entertainment company based in Burbank, as blockbuster films like “Inside Out 2”, “Deadpool & Wolverine” and “Moana 2” each raked in over $1 billion at box offices worldwide. In total, Disney’s movies amassed global earnings of more than $5 billion that year.

For the initial time, Disney’s streaming ventures, comprising Disney+, Hulu, and ESPN+, have managed to turn a profit.

However, the company encounters inquiries regarding less robust outcomes in its theme parks segment, a crucial revenue source for Disney. Moreover, Disney has been cautious about engaging in cultural debates on politics, especially given the Trump administration’s focus on challenging diversity, equity, and inclusion initiatives among businesses.

Hollywood Inc.

For quite some time now, I’ve noticed a gradual pullback from efforts aimed at promoting diversity, equality, and inclusivity within the movie-making industry and its related companies, as per what many industry insiders suggest.

Prior to the upcoming shareholder meeting slated for this coming Thursday morning, The Times consulted experts, including analysts and investors, on the issues they expect the company to tackle during the meeting.

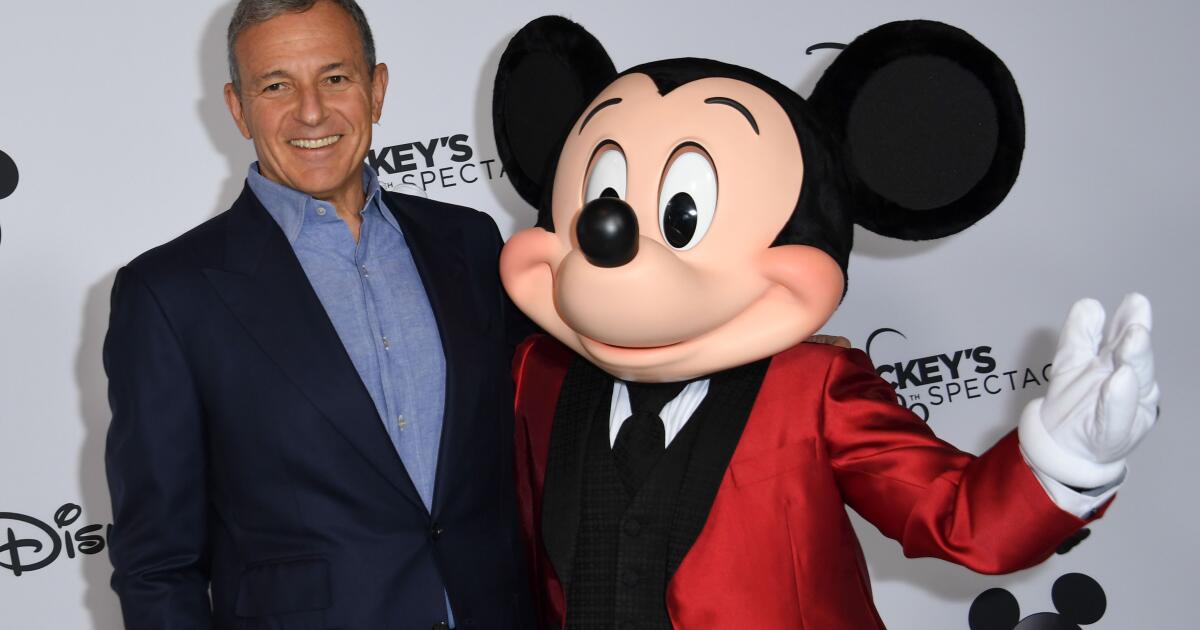

The CEO succession plan

Despite Disney not announcing a new CEO until early 2026, there’s growing anticipation among investors and experts for updates on the progress of the recruitment process.

Disney’s Co-Chairs Dana Walden, Alan Bergman, Josh D’Amaro who oversees parks, products, and experiences, and ESPN head James Pitaro are all thought to be strong candidates for future leadership roles within the company.

In simpler terms, the new chairperson of Disney’s board, James P. Gorman who was previously the head of Morgan Stanley, is leading the team responsible for selecting the next CEO. According to Disney, planning for executive succession continues to be one of the board’s main focuses.

Identifying a suitable replacement for Iger, aged 74, is crucial for ensuring the company’s long-term stability. Previously, the company struggled when trying to find a successor for Iger; the tenure of former CEO Bob Chapek, who recently stepped down, lasted less than three years.

Starting from when Robert Iger stepped down as CEO, Brian Mulberry, who holds the role of client portfolio manager at Zacks Investment Management, has been gradually selling off Disney shares. Although their portfolio does not presently hold any Disney stock, Mulberry is closely monitoring the stock’s price movements and plans to gather more information about certain financial concerns within the company before making a decision on whether or not to invest again.

In the upcoming meeting, there’s a lot of curiosity about who will take charge and steer the course correctly now that Bob Iger is leaving, as he put it.

Laurent Yoon, a senior analyst at Bernstein, mentioned that the ongoing uncertainty regarding the succession plan has been causing unease among investors.

Two years ago, Bob Iger returned, and the ambiguity surrounding the situation hasn’t become any more defined since then,” he stated.

Parks and recession fears

2024 saw Disney’s experience sector, encompassing theme parks, cruise lines, and merchandise, experiencing less vigorous development primarily due to inflationary pressures, increased expenses related to their cruise line expansion, and weaker performance at their overseas park locations.

Hollywood Inc.

Disney’s $2-billion development scheme for Disneyland underscores the significance of their theme parks in supporting their financial performance.

This summer, the company may encounter intensified competition in Florida, as Comcast Corporation is set to debut its Epic Universe theme park in Orlando. This has been a topic of frequent inquiry among analysts during Disney’s earnings conferences.

Disney projected a 6% to 8% increase in income from its experiences sector for the current year, as shared during their fourth-quarter earnings discussion in November. However, given the rising economic uncertainty and concerns about a possible recession, there is keen interest among analysts and investors to observe how Disney plans to tackle these potential risks to consumer spending.

According to Yoon, this summer is crucial for Disney as it’s anticipated that their theme park business will bounce back. However, if a recession occurs, that could pose a challenge. He also mentioned that there might be queries about the actions Disney would take if there are signs of larger economic pressures.

Prior to the widespread worry about an economic recession, doubts about the affordability of taking a Disney vacation had been steadily rising due to the gradual hike in park ticket costs throughout the years.

Since Gavin Doyle has held a few Disney stocks since 2009, he’ll be listening carefully for any discussions about discounts, promotional deals, or updates regarding park expansions.

Doyle, the founder of MickeyVisit.com, an affordable parks guide, mentioned that there are numerous strategies they can employ… strategies to attract visitors even during periods when interest might be decreasing.

Handicapping ESPN’s flagship streamer

Consumers find live sports particularly appealing, and it’s been announced that Disney will unveil their dedicated ESPN streaming service by the summer season.

Analysts and investors are keen to learn additional details such as pricing structure, visual aesthetics of the product, what sets its user experience apart from the ESPN channel on traditional TV, and how seamlessly it can integrate with other service providers.

According to Yoon of Bernstein, as Disney moves towards streaming instead of traditional TV, it’s crucial that this shift happens smoothly.

As a passionate cinephile, I’m thrilled to share that our beloved entertainment powerhouse has strategically placed an ESPN tab right on the Disney+ home screen! This move is designed to not only keep existing subscribers engaged but also attract new ones with the diverse content offerings from both Disney and ESPN. It’s a win-win for us fans!

Culture wars

A suggestion within the company’s official documents proposes a reevaluation of Disney’s involvement with the Human Rights Campaign’s Corporate Equality Index. This recommendation comes from the National Center for Public Policy Research, a conservative research organization.

Each year, the Corporate Equality Index evaluates companies based on how inclusive their workplaces are towards employees who identify as LGBTQ+.

The National Center for Public Policy Research, a group known for suggesting ideas at Disney’s annual shareholder meetings, has stated that Disney being included in the index suggests the company is engaging in “partisan activities.” They advise Disney to reconsider this involvement, as they have a responsibility or duty to their shareholders to make decisions that are financially sound.

Disney recommended its shareholders vote no on the proposal.

The suggestion in this proposal seems to refer to the ongoing cultural disputes that Disney has begun to distance itself from. Notably, the company admitted to scrapping a narrative about a trans athlete from one of its Pixar productions, stating that “many parents would rather address such topics with their children at their own pace and convenience.

As a dedicated film enthusiast, I’ve noticed that even the magic-making machine, Disney, has been making adjustments to their internal Diversity, Equality, and Inclusion (DEI) policies, just like many other studios in Tinseltown and businesses across various sectors.

Read More

- Clash Royale Best Boss Bandit Champion decks

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Mobile Legends January 2026 Leaks: Upcoming new skins, heroes, events and more

- Clash Royale Season 79 “Fire and Ice” January 2026 Update and Balance Changes

- World Eternal Online promo codes and how to use them (September 2025)

- M7 Pass Event Guide: All you need to know

- Clash Royale Furnace Evolution best decks guide

- Best Arena 9 Decks in Clast Royale

- Best Hero Card Decks in Clash Royale

- Clash of Clans January 2026: List of Weekly Events, Challenges, and Rewards

2025-03-20 04:01