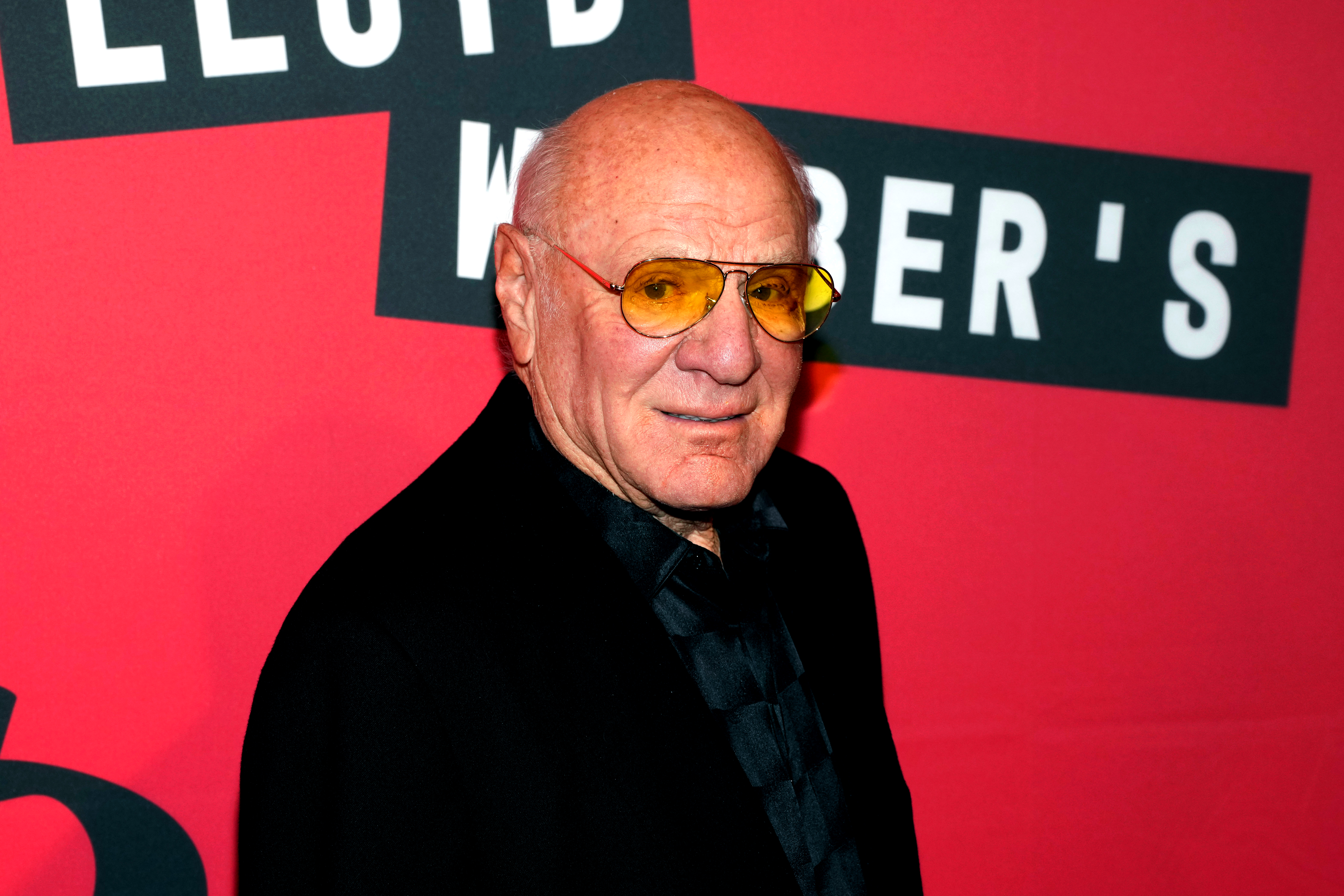

As a long-time fan of the dynamic world of media and entertainment, I can’t help but feel a sense of nostalgia and intrigue as I read about Barry Diller’s potential return to Paramount Pictures. Thirty years have passed since he was outmaneuvered in a brutal battle for control of the historic Hollywood studio. I still remember the epic saga that unfolded between Diller and Sumner Redstone, with the latter ultimately emerging victorious in a deal that left many questioning the value of the acquisition.

After being pushed out of the struggle for Paramount Pictures’ leadership thirty years ago, Barry Diller seems to be making another attempt.

Two sources close to the matter revealed that an 82-year-old media mogul is one of the potential buyers who have shown enthusiasm for acquiring National Amusements Inc., the Massachusetts-based firm owned by the Redstone family, which holds the decisive voting shares in Paramount Global.

As a movie enthusiast and reviewer, I’ve had the pleasure of exploring the extensive media empire that is Paramount Global. In simple terms, Paramount Global is my go-to destination for both classic and contemporary Hollywood productions, as well as being home to some beloved television networks. Among its many offerings are the iconic CBS broadcast network and a captivating collection of cable channels – MTV and Nickelodeon, to name but a few. So, whether I’m in the mood for a timeless movie or an engaging TV show, Paramount Global has got me covered!

In 1994, Sumner Redstone successfully outbid Diller in a fierce competition to acquire the Melrose Avenue film studio. The studio cost Redstone a huge sum of $10 billion, which left some industry insiders and even his own executives doubting the value of this expensive acquisition.

In the past, Redstone’s media empire, referred to as Viacom at the time, made a significant acquisition by purchasing the Blockbuster video chain. This deal was driven by the urgent need for cash flow to help manage the debt accrued from the Paramount purchase that Viacom had recently completed.

In the 1970s, Diller led Paramount through a successful era marked by expansion and critically-acclaimed films. Later, he stepped back from a bidding process with an casual gesture, his trademark move. Subsequently, he managed Universal, and eventually amassed great wealth by establishing powerful digital media companies under IAC.

The New York Times first reported Diller’s interest in National Amusements.

In the past few months, other prospective buyers have emerged, expressing interest to Shari Redstone about taking over the Redstone family’s business empire. Shari has been in charge since her father started dealing with health problems around eight years ago. Sadly, Sumner Redstone passed away in 2020.

As a devoted cinema enthusiast, I’m thrilled to share that there are a couple of potential gentlemen callers in the picture. Among them is Edgar Bronfman Jr., a former powerhouse executive at Seagram and Warner Music. Additionally, Hollywood producer Steven Paul has also entered the scene, known for his work on “Ghost in the Shell” and “Baby Geniuses.” However, it’s important to remember that any deal hinges on thorough research and investigation, commonly referred to as due diligence. Moreover, coming up with a substantial amount of money is crucial to persuade the Redstone family to consider relinquishing control over a business they’ve been deeply involved with for decades.

As a devoted cinema enthusiast, I can’t help but reflect on the past and the missed opportunity that Universal Studios Inc. represented. You see, there was once a man named Bronfman, an ex-entertainment executive with deep roots in the liquor industry. He had a vision to acquire this esteemed studio before it ended up in the hands of Vivendi from France. Regrettably, that was more than twenty years ago.

There’s uncertainty if Diller intends to make an offer to National Amusements, according to a well-informed source.

“IAC does not comment on rumors or speculation,” a company spokesperson said late Monday.

National Amusements is facing significant debt problems. For several months, Shari Redstone has been quietly trying to sell the company to tech mogul David Ellison for around $8 billion in a two-part transaction. If successful, Ellison’s Skydance Media would eventually merge with Paramount.

In June, following long periods of intense conflict and nervous anticipation in the boardroom, Redstone unexpectedly changed his mind, causing the planned sale of Paramount Global to Ellison’s Skydance Media to fall through.

National Amusements would have received approximately $2.2 billion from the Ellison deal, leaving around $1.7 billion for the Redstone heirs after settling the company’s outstanding debts.

National Amusements announced its endorsement of Paramount’s new leadership team: executives George Cheeks, Chris McCarthy, and Brian Robbins, who now hold key positions. The company also expressed approval for their business strategy, which involves $500 million in cost savings, and the board’s initiatives to seek ways to increase value for all Paramount shareholders.

Read More

- Mobile Legends: Bang Bang (MLBB) Sora Guide: Best Build, Emblem and Gameplay Tips

- Clash Royale Best Boss Bandit Champion decks

- Best Hero Card Decks in Clash Royale

- All Brawl Stars Brawliday Rewards For 2025

- Best Arena 9 Decks in Clast Royale

- Clash Royale Witch Evolution best decks guide

- Vampire’s Fall 2 redeem codes and how to use them (June 2025)

- Brawl Stars December 2025 Brawl Talk: Two New Brawlers, Buffie, Vault, New Skins, Game Modes, and more

- Call of Duty Mobile: DMZ Recon Guide: Overview, How to Play, Progression, and more

- Clash Royale Furnace Evolution best decks guide

2024-07-18 21:56